SBI, ICICI Bank cut savings deposit rates – Check new rates

SBI has reduced its savings deposit interest rates to 2.70 per cent across all slabs from May 31, according to its website.

Trending Photos

)

Mumbai: The country's largest bank State Bank of India (SBI) and second largest private sector lender ICICI Bank have reduced interest rates on savings bank deposits by 5 basis points and 25 basis points, respectively.

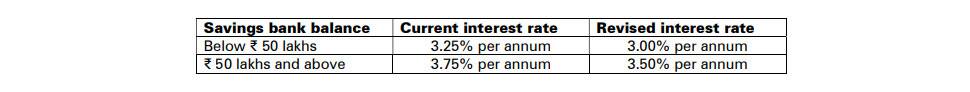

ICICI Bank, in a regulatory filing on Tuesday, said it has cut interest rates on all deposits of less than Rs 50 lakh by 25 bps to 3 per cent from 3.25 per cent.

"ICICI Bank has announced a reduction in its savings bank account interest rate with effect from June 4, 2020," the bank said in a BSE filing.

For deposits of Rs 50 lakh and above, the private lender's account holders will earn an interest of 3.50 per cent, down from 3.75 per cent currently.

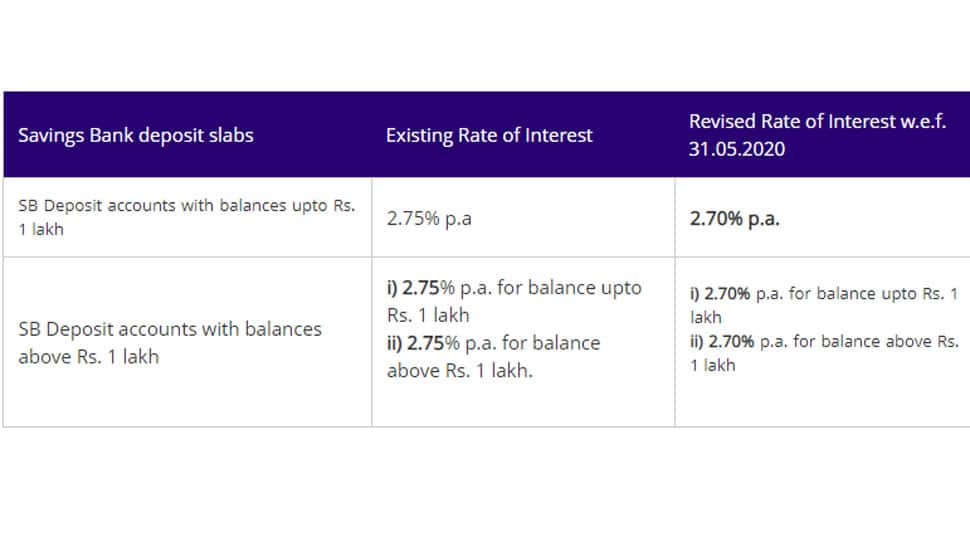

SBI has reduced its savings deposit interest rates to 2.70 per cent across all slabs from May 31, according to its website.

This is the second reduction by SBI in its interest rates on savings bank deposits in this fiscal.

In April, the bank had cut savings bank deposit rates by 25 basis points (bps) to 2.75 per cent per annum across all slabs. The bank has two slabs for savings bank deposits -- those with balance up to Rs 1 lakh and those above Rs 1 lakh.

SBI, on May 27, had slashed its retail term deposit rates by up to 40 bps across all tenors. For deposits maturing in seven days to 45 days, SBI is offering an interest rate of 2.90 per cent as against 3.30 per cent earlier. It revised rate for fixed deposits in 180 days to 210 days bracket to 4.40 per cent from 4.80 per cent earlier.

Interest rate for deposits maturing in 5 years to 10 years has been cut to 5.40 per cent from 5.70 per cent earlier. The bank has also cut interest rates for bulk deposits (Rs 2 crore and above) by up to 50 basis points.

Banks have been lowering their deposit rates as they have ample liquidity, but demand for fresh loans is very low.

With PTI Inputs

Stay informed on all the latest news, real-time breaking news updates, and follow all the important headlines in india news and world News on Zee News.

Live Tv

)

)

)

)

)

)

)

)

)

)