PPF Investment Strategy: Turn Rs 12,500 per month into Rs 2.27 CRORE in just 15 years; Check interest rate, return calculator & other key details

Money-making tips: Check out this return calculator to turn Rs 12,500 per month investment into Rs 2.27 crore

- PPF falls under the EEE classification.

- The maturity period in this case is 15 years.

- You have to invest Rs 12,500 per month.

Trending Photos

) File Photo

File Photo New Delhi: For long-term investors who are risk-averse and wish to park their money in risk-free schemes, Public Provident Fund, or PPF, is one of the most well-liked investing options among all Indian citizens. The scheme offers reliable and alluring returns. An investor can acquire a sizeable sum of wealth through PPF in a few years if they invest in this programme consistently and systematically.

The Public Provident Fund, or PPF, is a high-yielding, small-savings programme backed by the government that aims to bring investors long-term prosperity after retirement. PPF is another investment vehicle that falls under the exempt-exempt-exempt (EEE) classification. (Also Read: Public Provident Fund: Invest Rs 100 per day in PPF, get Rs 25 lakh at the time of retirement; Check details here)

A guardian acting on behalf of a minor or person of unsound mind may create a PPF account under the government-sponsored modest saving scheme with a minimum deposit of Rs 500 and a maximum yearly commitment of Rs 1.5 lakh. (Also Read: What happens to the money after PPF account holder's death? Here's the detail)

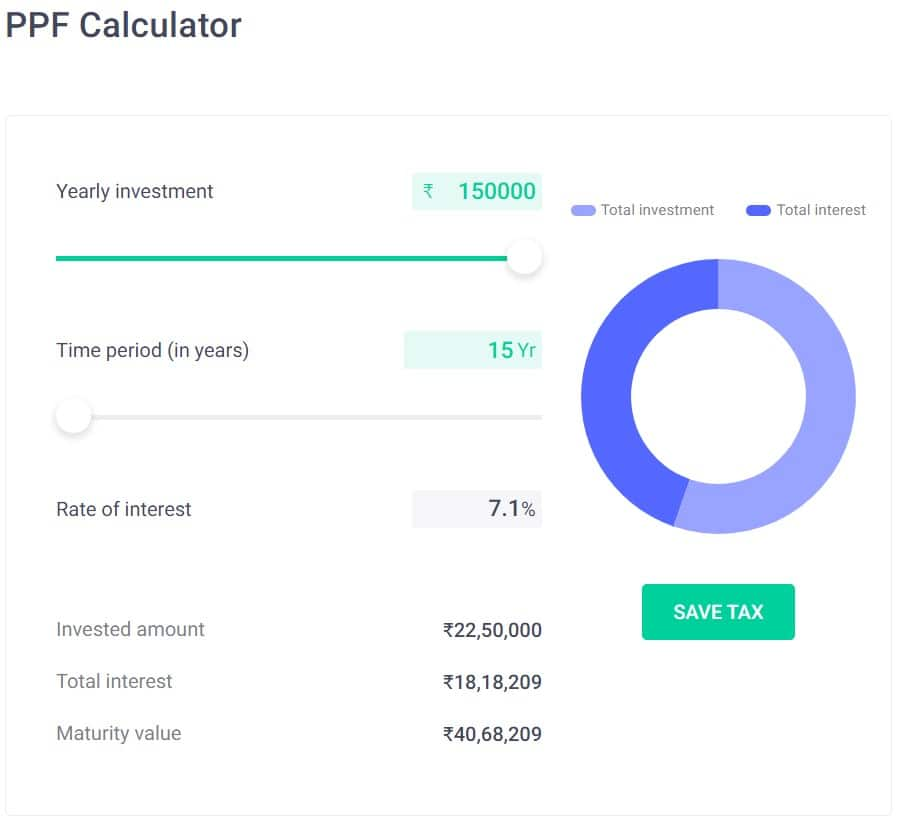

Return calculator

For instance, an investor would receive almost Rs 2.27 crore at maturity if they invested Rs 12,500 per month or Rs 1.50 lakh annually in their PPF account. However, it must be kept in mind that PPF accounts have a 15-year maturity limit and can only be extended by submitting Form 16-H.

A PPF account may be extended in a block of five years; to do so, one must complete Form 16-H in the fifteenth year following the inception of the PPF account. If they want to continue investing beyond 20 years from the date of account inception, they must complete another Form 16-H.

An individual must complete Form 16-H in the 15th, 20th, 25th, and 30th years after starting a PPF account in order to extend investments in the account for 35 years.

A monthly investment of Rs 12,500, or just Rs 1.50 lakh in a year, would equate to a maturity amount of Rs 2,26,97,857, or around Rs 2.27 crore, if the current PPF interest rate of 7.10% were to be applied for the ensuing 35 years.

The PPF interest earned throughout this time would be almost Rs 1.68 crore, despite the fact that the invested amount over the years would be Rs 52.5 lakh.

Stay informed on all the latest news, real-time breaking news updates, and follow all the important headlines in india news and world News on Zee News.

Live Tv

)

)

)

)

)

)

)

)

)

)