Post Office Rs 399 Insurance Scheme: India Post offering Rs 10 lakh cover in THIS accident policy

To protect its customers from eventualities like accidental death or disability, the India Post Payments Bank has come out with an accidental insurance policy for just Rs 399 and Rs 299.

- India Post Payments Bank has come out with two cheaper accidental insurance

- Both Rs 399 and Rs 299 plans offer Rs 10 lakh coverage in case of accident

- The policy can be purchased for one year and needs to be renewed

Trending Photos

) The IPPB customers aged between 18-65 years can avail the benefits of these two policies for one year by paying the required premium.

The IPPB customers aged between 18-65 years can avail the benefits of these two policies for one year by paying the required premium. India Post not only provides postal delivery services but is a go-to medium for many when it comes to banking services, especially in the rural areas. Today, India Post has a huge network across the country. Now, in order to protect its customers from eventualities like accidental death or disability, the India Post Payments Bank has come out with an accidental insurance policy for just Rs 399 and Rs 299. While the premium plan is offered to IPPB customers for Rs 399, the basic plan cost Rs 299 for a year.

Life is full of uncertainties and accidents can happen to anyone at any time. While accidents are not planned, one can certainly plan for accidental expenses. Now, IPPB's group personal accident insurance provides accident coverage for all of its customers. Purchasing an accidental insurance can be the best option for keeping unanticipated expenses under check.

The IPPB customers aged between 18-65 years can avail the benefits of these two policies for one year by paying the required premium.

Also Read: 'Juice Jacking': Charging your phone in public may drain out your bank accounts, credit cards

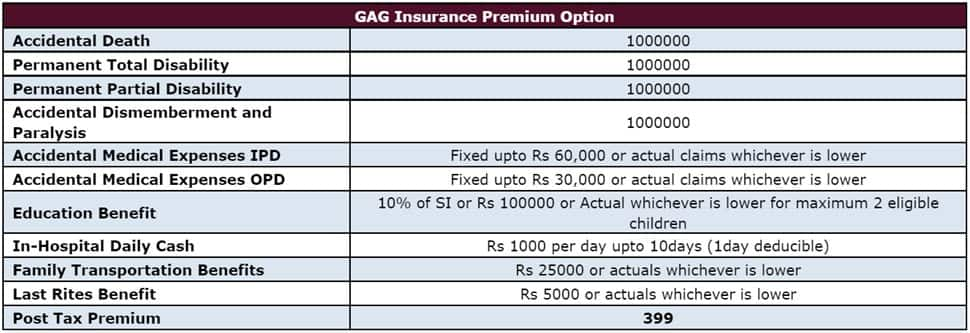

India Post's Rs 399 Premium Insurance Plan

The Rs 399 premium plan offers you a cover for a year. It promises to give you Rs 10 lakhs in case of accidental death or permanent total disability, permanent partial disability and accidental dismemberment and paralysis. One can also claim accidental medical expenses in IPD up to Rs 60,000 and Rs 30,000 in case of accidental medical expenses in OPD.

If you are hospitalized, you will be getting Rs 1000 per day for ten days.

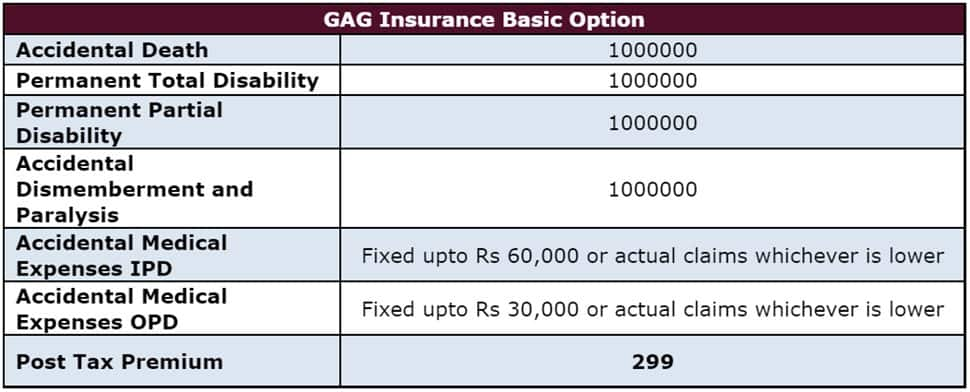

India Post's Rs 299 Basic Insurance Plan

As part of its Rs 299 basic insurance plan, IPPB is offering coverage of Rs 10 lakhs in the case of accidental death or permanent total disability, permanent partial disability and accidental dismemberment and paralysis. However, this policy doesn't offer benefits like Education Benefit, In-Hospital Daily Cash, Family Transportation Benefits and Last Rites Benefit as offered under the premium Rs 399 plan. The Rs 299 plan, however, offers Rs 60,000 in case of accidental medical expenses in IPD and Rs 30,000 in case of accidental medical expenses in OPD.

Key Benefits of the Post Office Rs 399 Insurance plan

* Accidental Death: It covers Death due to an accident within 365 days of the accident date. Coverage limit is 100% of Sum Insured.

* Accidental Dismemberment and Paralysis: It covers Dismemberment which is permanent in nature & occurs within 365 days of the accident Date. Paralysis is the loss of the ability to move (and sometimes to feel anything) in part or most of the body, as a result of an Injury.

* Education Benefit: Entire sum insured is payable in case of accidental death / permanent total disability. Benefit payable for eligible child who is full time student in any Institution.

* Permanent Total Disability: It covers Total Disability which is permanent in nature & occurs within 365 days of the accident Date. Coverage limit is 100% of Sum Insured.

* Permanent Partial Disability: It covers Partial Disability which is permanent in nature & occurs within 365 days of the accident Date. Coverage limit is as per % specified in policy document.

However, the Post Office Accident Insurance policy doesn't cover suicide, military services or operations, war, illegal act, bacterial infection, disease, AIDS, or dangerous sports to name a few exceptions.

Stay informed on all the latest news, real-time breaking news updates, and follow all the important headlines in india news and world News on Zee News.

Live Tv

)

)

)

)

)

)

)

)

)

)