New Income Tax Slabs Budget 2023 Highlights: Big Rebate on Income Tax, NO Tax on Income up to Rs 7 Lakh in new tax Regime

Income Tax Slabs Budget 2023 LIVE Updates: Currently, those with an income of Rs 5 lakhs do not pay any income tax and I proposed to increase the rebate limit to Rs 7 lakhs in the new tax regime

Trending Photos

) Income Tax Slabs Budget 2023 LIVE Updates

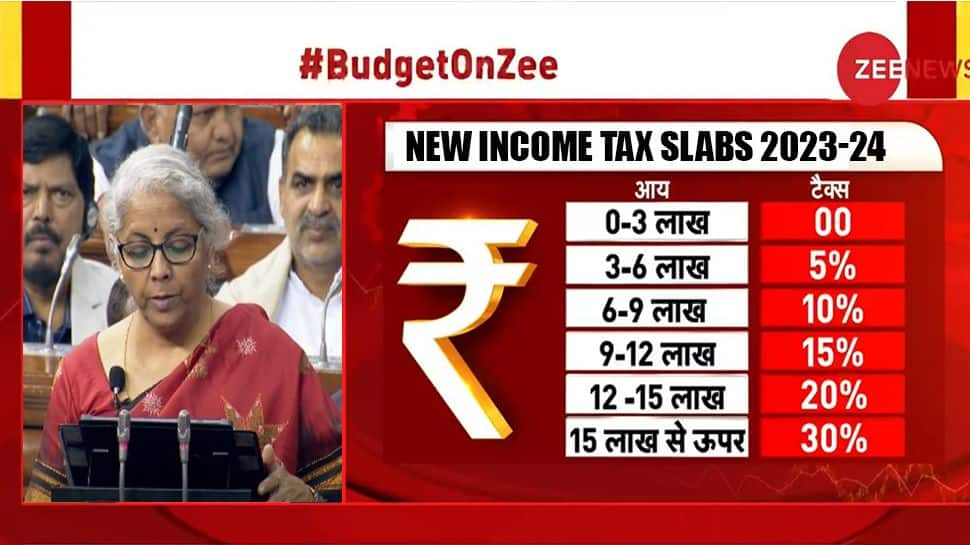

Income Tax Slabs Budget 2023 LIVE Updates Income Tax Slabs Budget 2023 LIVE Updates: Finance Minister Nirmala Sitharaman on Wednesday announced big sop for individual Tax payers. On the Personal Income Tax front, FM has raised the income tax slab for tax payers.

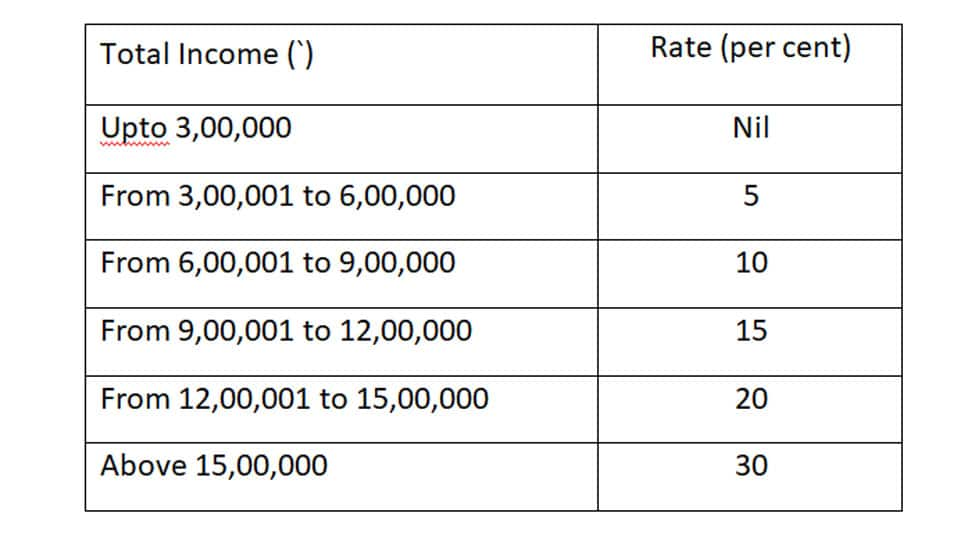

As per the the new tax rates from 0 to Rs 3 lakhs - individual tax payer will not have to pay any tax, for Rs 3 to 6 lakhs - 5% tax will be levied, Rs 6 to 9 Lakhs - 10% tax will be levied, Rs 9 to 12 Lakhs - 15% tax will be levied, Rs 12 to 15 Lakhs - 20% tax will be levied and above 15 Lakhs - 30% tax will be levied, said the FM

"I introduced in 2020, the new personal income tax regime with 6 income slabs, starting from Rs 2.5 Lakhs. I propose to change the tax structure in this regime by reducing the number of slabs to 5 and increasing the tax exemption limit to Rs 3 Lakhs," FM added

"Currently, those with an income of Rs 5 lakhs do not pay any income tax and I proposed to increase the rebate limit to Rs 7 lakhs in the new tax regime," FM Sitharaman presenting her Budget speech said.

The Income Tax slabs and tax rates have not been changed for a long time now. Though the Finance Minister introduced a new tax regime in the Budget in 2020, it did come with a catch on deductions. A change in the income tax slab is seen as a huge relief for millions of individual taxpayers who are reeling under high inflation.

Budget 2023 LIVE Streaming on Zee News:

Here are the Highlights of Budget 2023 Announcement

Stay informed on all the latest news, real-time breaking news updates, and follow all the important headlines in india news and world News on Zee News.

)

)

)

)

)

)

)

)

)

)